Welcome to AI Street! I'm Matt Robinson, a longtime financial journalist, and I’m here to help you understand how AI is reshaping Wall Street. Every Thursday, I share the latest news, analysis and expert interviews. Feedback? Reach out: [email protected]

The Rundown

S&P + Accenture Start AI Program

Interns Expect Gen AI at Work: BlueFlame Survey

How AQR, Balyasny, Man Group are using AI

Writer’s New LLM Passes Wall Street’s Toughest Test

AI Outperforms Human Analysts in Earnings Predictions: Study

Bipartisan Bill Proposes AI Sandboxes for Financial Firms

Quick Links

AI ADOPTION

S&P Launches AI Training Program

S&P Global is partnering with Accenture to train its 35,000 employees in generative AI skills, the companies announced August 6. The initiative includes a comprehensive learning program and plans to develop AI benchmarks for the financial industry. S&P Global aims to enhance productivity and enable higher-value work, potentially reshaping financial data analysis and decision-making on Wall Street.

Benefits for financial firms:

Enhanced management and scaling of large language models (LLMs), AI systems trained on vast amounts of text data.

Improved evaluation of LLM performance for financial and quantitative use cases.

Access to fine-tuning and prompt engineering services.

Bhavesh Dayalji, S&P Global's chief AI officer, said: "We want to bring this to all of our employees, whether they're in finance, legal, or sales."

BIG PICTURE: S&P’S BET ON AI BENCHMARKS

This will likely accelerate AI adoption across financial services, as competitors and clients look to keep pace. But implementation will take time given the complexity of financial firms and the paramount need for accuracy.

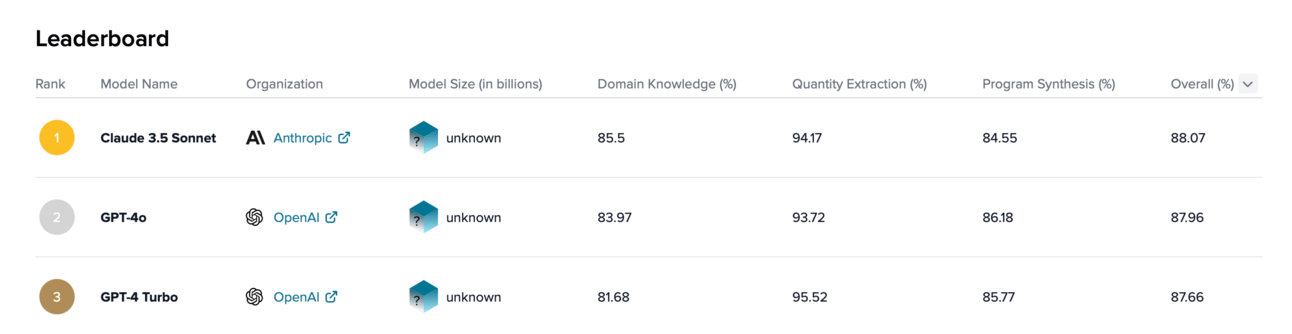

What stood out to me is S&P’s benchmarks for AI. It’s hard to compare models since it’s not always an apples to apples comparison but I think non-experts want at least some third-party benchmark. (It’s worth checking out how some general models perform; you’ll see that Anthropic’s Claude 3.5 Sonnet has the top spot).

More: S&P Global partners with Accenture, launches massive AI training program for 35,000 employees (VentureBeat)

Interns Expect Generative AI at Work: BlueFlame Survey

A survey of more than 50 summer interns at private equity firms by BlueFlame AI shows that the younger generation expects their employers to provide AI tools:

50% use ChatGPT daily, 83% use it weekly

94% believe AI and LLMs will increase work efficiency

89% expect employers to provide enterprise-grade AI/LLM access

33% would reconsider their choice of employer if not provided access to enterprise AI tools

“The newer generation is taking to this technology very, very quickly,” Raj Bakhru, CEO of BlueFlame AI, a generative AI platform for alternative investment managers, told AI Street.

The company tailors its pitch to cater to different demographics. The younger generation prefers chatbots, associates who rely on spreadsheets benefit from the Excel plugin, and senior professionals like click-based user interfaces for simplicity, says Bakhru.

“AI is going to change everything, top to bottom, over time, but it’s not going to happen overnight,” says Bakhru.

Created with DALL-E

How large hedge funds AQR, Balyasny, Man Group are using AI

Major hedge funds, including AQR Capital Management, Balyasny Asset Management, and Man Group, are expanding their use of AI, per Pensions & Investments.

Man Group: Developed Man GPT, the firm’s version of ChatGPT, an interface anyone at the firm can use, for data interaction and code suggestions. Developers are using about 20% of AI-suggested code, boosting productivity.

Balyasny: Implemented AI for report generation. Central bank preview report creation reduced from 2 days to 30 minutes.

AQR: Focuses on AI for textual data analysis and custom language models.

Outlook: AI expected to become "table stakes" in the hedge fund industry

Charlie Flanagan, Balyasny’s head of applied AI, said the current moment in time is a “platform shift” akin to the internet in the late 1990s and the introduction of the Apple iPhone.

“I do think this moment in time, we'll look back on and say that that was the moment that things changed,” he said.

INVESTING

Writer’s New AI Model Passes CFA Level III Exam

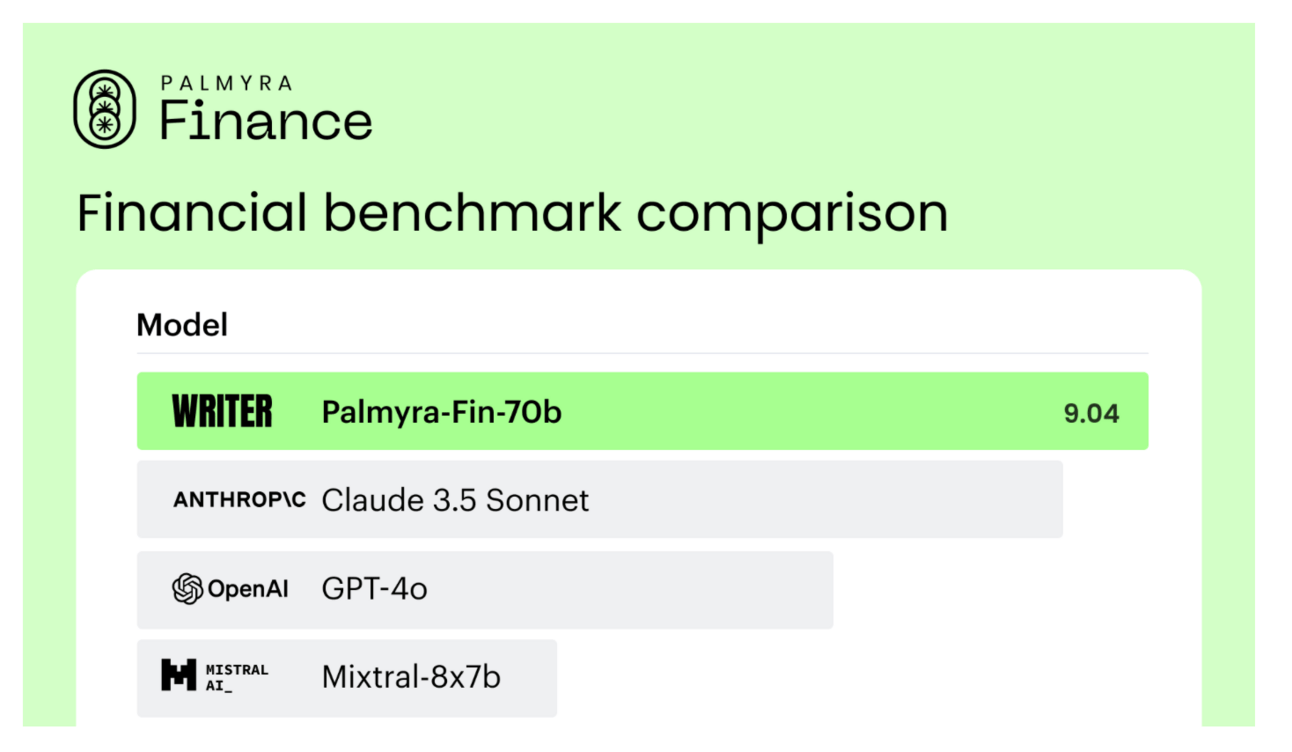

Writer has released a LLM specialized for finance that the company claims is the first to pass CFA Level III exam, one of the most challenging tests for money managers.

Writer, the San Francisco AI company, released the open-source Palmyra-Fin-70b model on July 31. The AI model is designed for forecasting, investment analysis, and risk evaluation. The company says the new model outperformed general-purpose models like GPT-4o and Claude 3.5 Sonnet on financial tasks.

It's available through NVIDIA's AI services, Hugging Face, and Baseten platforms. Commercial licensing is available through Writer, though specific pricing details were not disclosed.

Vanguard, Franklin Templeton and Intuit are using the company’s LLMs in their workflows, per Writer.

BIG PICTURE: SHIFT TO SMALL MODELS

While much of the media coverage has been about ChatGPT and some of the other large language models, a lot of the industry is now moving toward smaller models and in particular subject or domain specific ones. This shift could lead to more efficient and targeted AI applications in finance, potentially accelerating adoption.

🤖💻AI Investor Tools 📊💼

I’m building a database of AI tools and platforms for investors. Have suggestions / favorites?

Reach out: [email protected]

AI Outperforms Human Analysts in Earnings Predictions, Study Finds

A new study suggests that AI can surpass financial analysts in predicting company earnings.

Key Findings:

GPT-4 Turbo analyzed financial statements from 15,000+ companies (1968-2021).

AI correctly predicted earnings growth/decline 60.35% of time vs. 52.71% for human analysts.

Human analysts failed to match AI performance even with forecast updates throughout the year.

"It's very important to have a human in the loop, of course," Valeri V. Nikolaev, co-author of the study and professor at the University of Chicago, told the WSJ. However, he added that AI could potentially take "the driver's seat" in financial analysis.

The study revealed that human analysts still outperform AI when evaluating smaller, loss-making firms. Researchers noted that analysts can incorporate "specific narrative contexts" unavailable to the AI model.

The findings raise questions about the future role of financial analysts. As Nikolaev put it, the research challenges "whether financial analysts will continue to be the backbone of informed decision-making in financial markets."

REGULATION

Bipartisan Bill Proposes Regulatory Sandboxes for AI

A bipartisan group of lawmakers introduced legislation on Monday that directs federal financial regulators to establish "regulatory sandboxes" for financial firms.

These sandboxes would provide a controlled environment where companies can experiment with AI-driven products and services without the full burden of existing regulatory frameworks. The goal is to allow for innovation in areas that may not fit neatly into current law.

Under the bill, participating firms would be granted some protection from regulatory oversight and enforcement actions while testing their AI projects.

Led by Sens. Mike Rounds (R-S.D.) and Martin Heinrich (D-N.M.) plus Reps. French Hill (R-Ark.) and Ritchie Torres (D-N.Y.), the bill is titled the Unleashing AI Innovation in Financial Services Act, per Punchbowl News.

Read the legislative text here.

Created with DALL-E

The sandboxes would be set up at the following financial regulators:

Federal Reserve

Office of the Comptroller of the Currency

Federal Deposit Insurance Corporation

Securities and Exchange Commission

Consumer Financial Protection Bureau

National Credit Union Administration

Federal Housing Finance Agency

More: Senate Commerce Committee advances several bills on AI (FedScoop)

QUICK LINKS

AI Companies Fight to Stop California Safety Rules

Industry says a bill moving through the state legislature would chill innovation for the young technology. (WSJ)

Also: ‘The Godmother of AI’ says California’s well-intended AI bill will harm the U.S. ecosystem (Fortune)

Pagaya Expands AI-Underwriting Reach With OneMain

Pagaya Technologies Ltd. is expanding its reach in the auto-lending industry through a new partnership with OneMain Holdings Inc. (Bloomberg Law)

Santander Creates Deepfakes to Warn of AI Scams

Santander has launched a campaign to demonstrate the threat to consumers from 'deepfake' videos circulating on social media platforms. (The Independent)

Lloyds Taps AWS Vet Rohit Dhawan to Lead AI Efforts

British banking giant Lloyds has picked an Amazon Web Services veteran as its AI head. (PYMNTS)

Savvy Wealth Closes Series A at $26.5 million

Fintech platform provider (and RIA owner) Savvy Wealth has wrapped a $26.5 million Series A funding round. (Wealthmanagement)

AI ODDITIES

AI + Animals: Cats Get Creepy Makeover

A cottage industry has arisen around bizarre cat videos made with the help of AI. (Washington Post)

Thanks for reading!

I'm in the process of building two databases: one is a list of AI tools for investors, and another is for AI adoption by banks, hedge funds, and asset managers. And I hope to share both in the coming weeks.

Feedback? Reach out at [email protected].