Hi, I'm Matt. You’re reading AI Street, where AI meets Wall Street. Every Thursday, I share curated news, analysis, and expert interviews.

The Rundown

Generative AI tools For investors

Five minutes with Aveni CEO

California passes contentious AI bill

Magnetar starts Gen AI-focus fund

NVIDIA earnings

Klarna Looks to AI to shrink workforce

🇺🇸 Matt in Milan 🇮🇹

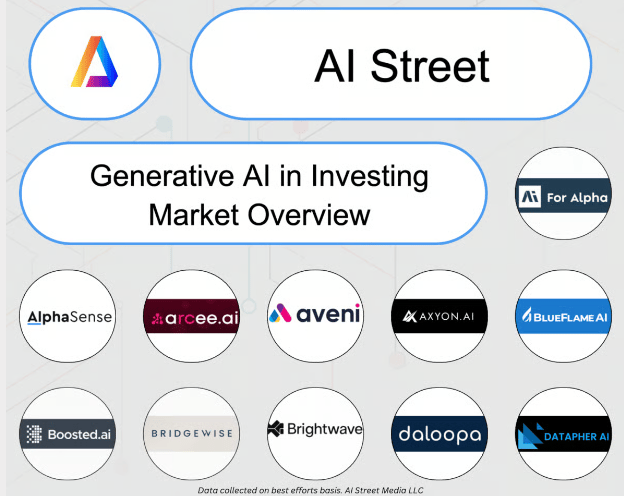

GEN AI INVESTING TOOLS

AI Street Compilation

It’s hard to keep track of all the companies leveraging AI for investing so I put together a list, which spans more than 30 firms from all over the world. These tools are for institutional and individual investors. Some are using AI to spot accounting fraud, while others are automating reports on little-covered companies.

If you’d like a copy of the overview, please email me at [email protected]

INTERVIEW

Aveni CEO on Building a Finance LLM

Instead of using all-purpose AI systems, like Open AI, the finance industry is moving towards smaller AI tools.

Think of LLMs as large libraries with thousands of books, while smaller domain language models are specialized bookstores focused on a single subject. Where LLMs offer breadth and versatility at the cost of precision, domain-specific models trade general knowledge for deep expertise in their niche.

That pitch helped Joseph Twigg, CEO and co-founder of Aveni, secure £11 million in Series A funding last month.

The Edinburgh-based company, founded in 2018, is developing a finance-specific language model, FinLLM, in partnership with Lloyds and Nationwide, two of U.K.’s largest banks. The model aims to set the standard for transparent, responsible, and ethical adoption of Generative AI across UK financial services.

The 43-year-old executive shares his thoughts on AI adoption, the challenges of implementing AI in financial services, and the future of domain-specific language models.

Why develop a finance-focused LLM?

The first phase of large language models like ChatGPT faced challenges with hallucinations, trust, and correctness. Over the last 12 months, we've realized that smaller, specialized models can deliver the necessary automation for specific use cases more effectively.

FinLLM is our own large language model, specifically designed for financial services. It's important to note that we're not using existing models like GPT or Claude. Instead, we're using open-source datasets that have been used to train other foundational models as our starting point, aiming to grow from about a billion parameters to around 70 billion.

You can read the full interview here.

REGULATION

California Assembly Passes Contentious AI Safety Bill

The California State Assembly has approved a contentious AI safety bill, SB 1047, with 41 votes in favor and 9 against. The bill requires companies developing AI models to take "reasonable care" to prevent severe harm, such as mass casualties or significant property damage. It mandates safety measures like implementing kill switches and submitting models for third-party testing.

The legislation has sparked debate among tech leaders, politicians, and AI companies. Critics, including major tech firms and some Democrats like Nancy Pelosi, argue that the bill could stifle innovation and drive AI companies from California. Supporters, including Tesla CEO Elon Musk and AI company Anthropic, believe the benefits outweigh the costs.

State Senator Scott Wiener, the bill's author, defended it against criticism, emphasizing that it only applies to companies investing substantial amounts in AI development. The bill also includes whistleblower protections for employees at AI companies who want to share safety concerns.

The bill now returns to the state Senate for a confirmation vote and possible amendments before reaching Governor Gavin Newsom, who has until September 30 to sign or veto the legislation. (Reuters)

Created with Ideogram

AI Training Data Transparency Bill Passed in California

A measure that would require AI companies to be more transparent about the data they use to train their models cleared the California legislature. It now heads to Newsom, who hasn't weighed in on the bill, per Bloomberg.

State Banking Regulators Create AI Advisory Group

The Conference of State Bank Supervisors established an AI advisory group to counsel both the agency and state financial supervisors on the development and use of the technology. See the list of members here.

HEDGE FUNDS

Magnetar Starts Venture Fund, Targets Gen AI

Created with Ideogram

Magnetar Capital, the $17.5 billion money manager known for alternative credit and hedge fund investing, is pushing into newer territory: venture capital.

Magnetar has launched its first-ever dedicated fund for backing startups, with a focus on Gen AI. It’s the first step in a broader move to build out a venture business.

“We are going through a generational technology revolution that’s going to require possibly trillions of dollars of investments,” said Jim Prusko, Magnetar’s senior portfolio manager who is helping oversee the fund. “So there are going to be many opportunities given the scale and rapidly changing nature of AI and machine learning technology.” (Bloomberg)

AI BUBBLE?

NVIDIA Earnings

I track a lot of AI news (of course) and my feed has mostly been about NVIDIA’s earnings and what it says about whether we’re in an AI bubble or not. This reminds me of a Stanley Druckenmiller interview from earlier this year on AI. He said AI might be a little over-hyped now, but under-hyped long term. I tend to agree.

AI ADOPTION

Klarna to use AI to halve workforce

Klarna saw revenue rise 27% in the first half of 2024, buoyed by its aggressive use of AI, which CEO Sebastian Siemiatkowski says could help the buy now, pay later giant halve its workforce. (Finextra)

Despite the buzz around GenAI, asset managers are proceeding cautiously: KPMG

Forty percent are in the conceptual phase, 25% are developing capabilities, and nearly a third haven't started. Less than 5% have a clear strategy, according to a recent investor survey from KPMG.

Created with Ideogram

BMO AI Bot Enables 3M customer interactions

BMO reported that nearly 3 million AI-enabled customer interactions were performed by its AI-driven chatbot, BMO Assist, according to its Aug. 27 earnings for the quarter ended June 30. (Bank Automation News)

Why Honeywell has placed such a big bet on gen AI

Sheila Jordan is such a big believer of generative artificial intelligence that she’s already put it into the hands of all 95,000 employees at Honeywell. (Fortune/ Yahoo)

MATT IN MILAN

🇺🇸 👨 🇮🇹

My wife patiently reads these newsletters before they reach your inbox, and she’s said once or twice ‘It’s kind of heavy. Can you end with something lighter?’ So a few times I’ve added some AI + pets stories, like this one about AI decoding dog barks, but I’ve not found a surplus of FidoGPT stories to keep this theme up, so I’m going to try something different this week.

For those that don’t know, I moved to Milan in July after 15+ years in NYC and so far so good. But I do have some very American thoughts to myself living in a foreign country. Like how my pockets are weighed down by coins. Italy is not as card friendly as the States, so you end up carrying a lot of bills and then inevitably tons of change. I feel like Kramer in the calzone episode…

See you next week!

Thanks for reading!

Drop me a line if you have story ideas, research, or upcoming conferences to share. [email protected]